FlexPayroll is a smart payroll system built for Microsoft Dynamics 365 F&O. It’s made for businesses with offices in different regions and helps manage tax rules easily through a flexible and powerful tax engine

A complete solution to simplify your Dynamics 365 payroll and HR procedures is provided by FlexPayroll for Payroll & HR. FlexPayroll is highly flexible and configurable to fit your company’s specific needs.

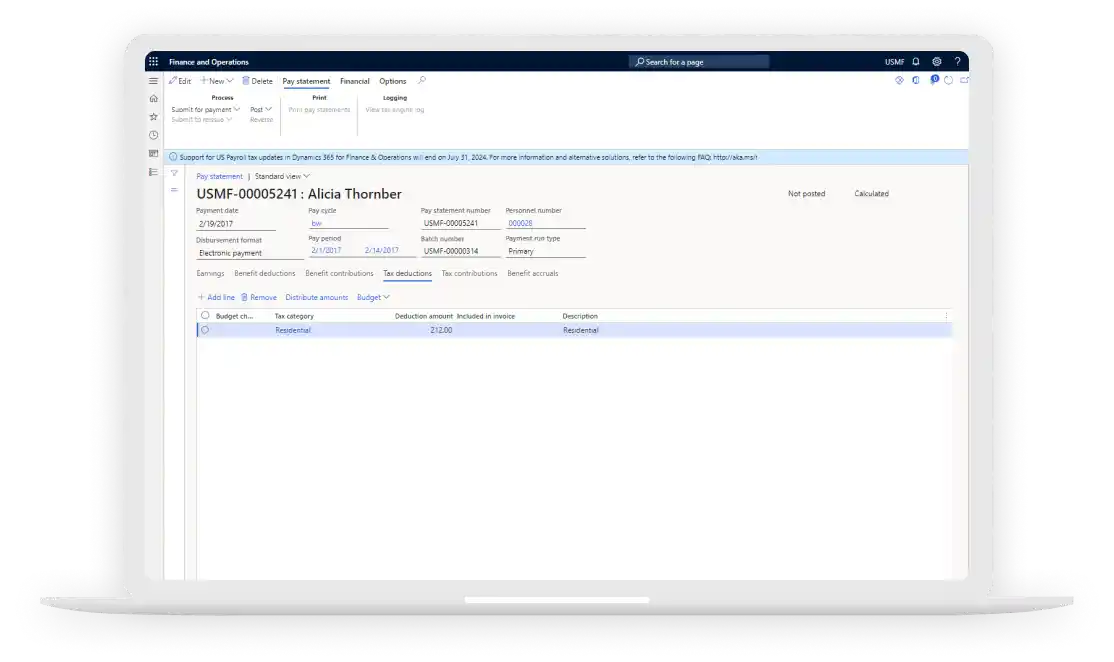

Accurate Tax Calculations for Payroll

Its flexible tax engine ensures accurate payroll tax deductions.

Customizable Taxation Rules

With FlexPayroll for Dynamics 365, you can define your own tax rules and sub-rules based on your company’s policies.

Reporting and Analytics

FlexPayroll delivers helpful reports and analytics tools for better decision-making

Formula-Based Functionality

It supports formula-based logic to connect rules and automate calculations effectively.

FlexPayroll for Dynamics 365 is a strong and reliable payroll system that helps businesses handle payroll efficiently and accurately. Here’s how it works:

Integration with Dynamics 365 F&O

FlexPayroll is designed to integrate smoothly with Microsoft Dynamics 365 Finance and Operations. This tight integration keeps payroll data synced with your business systems—minimizing errors and streamlining processes.

Defined Tax Information

No Change to Payroll Process

Easy Payroll Calculations

To stay ahead in today’s fast-moving business environment, you need efficient tools like FlexPayroll for Dynamics 365 payroll.

●Adaptable Workflows

Tailored approval processes to meet industry-specific needs

●Integration-Ready

Seamless integration with ERP systems like Microsoft Dynamics 365.

●Enhanced Transparency

Real-time tracking and reporting for better decision-making.

●Scalable Solution

Supports small to enterprise-level operations with ease.

We stand by our product with dedicated support:

●Break Fix Support:

Provided after deployment under a signed contract.

●Self-Service Portal:

Log tickets and access additional resources at your convenience.

●Free Hotfixes:

Delivered via email to ensure uninterrupted service.

Stevin Rock is one of the world’s largest crushed rock producers. They supply high-quality limestone, dolomite, and gabbro products to diverse industries like construction, steel, and cement. Facing inefficiencies due to an outdated ERP system without a modern Supplier Relationship Management (SRM) module.

Find quick answers to common questions about the platform’s features, functionality, and support to help you get started with ease.

What is FlexPayroll and why should my organization use it?

FlexPayroll is an advanced payroll management solution designed for Dynamics 365 Finance and Operations. It automates payroll processes, ensures compliance with local tax regulations, and reduces manual effort — all within your existing Dynamics 365 environment.

How does FlexPayroll handle payroll across different countries or legal entities?

Will implementing FlexPayroll disrupt our current payroll processes?

What reporting capabilities does FlexPayroll offer?

How do we get started with FlexPayroll?

Fill out the form below — our team will get back to you shortly